Perella Weinberg Partners (PWP)·Q4 2025 Earnings Summary

Perella Weinberg Q4 2025 Earnings: Beats Estimates But Stock Falls as FY Revenue Declines 14%

February 6, 2026 · by Fintool AI Agent

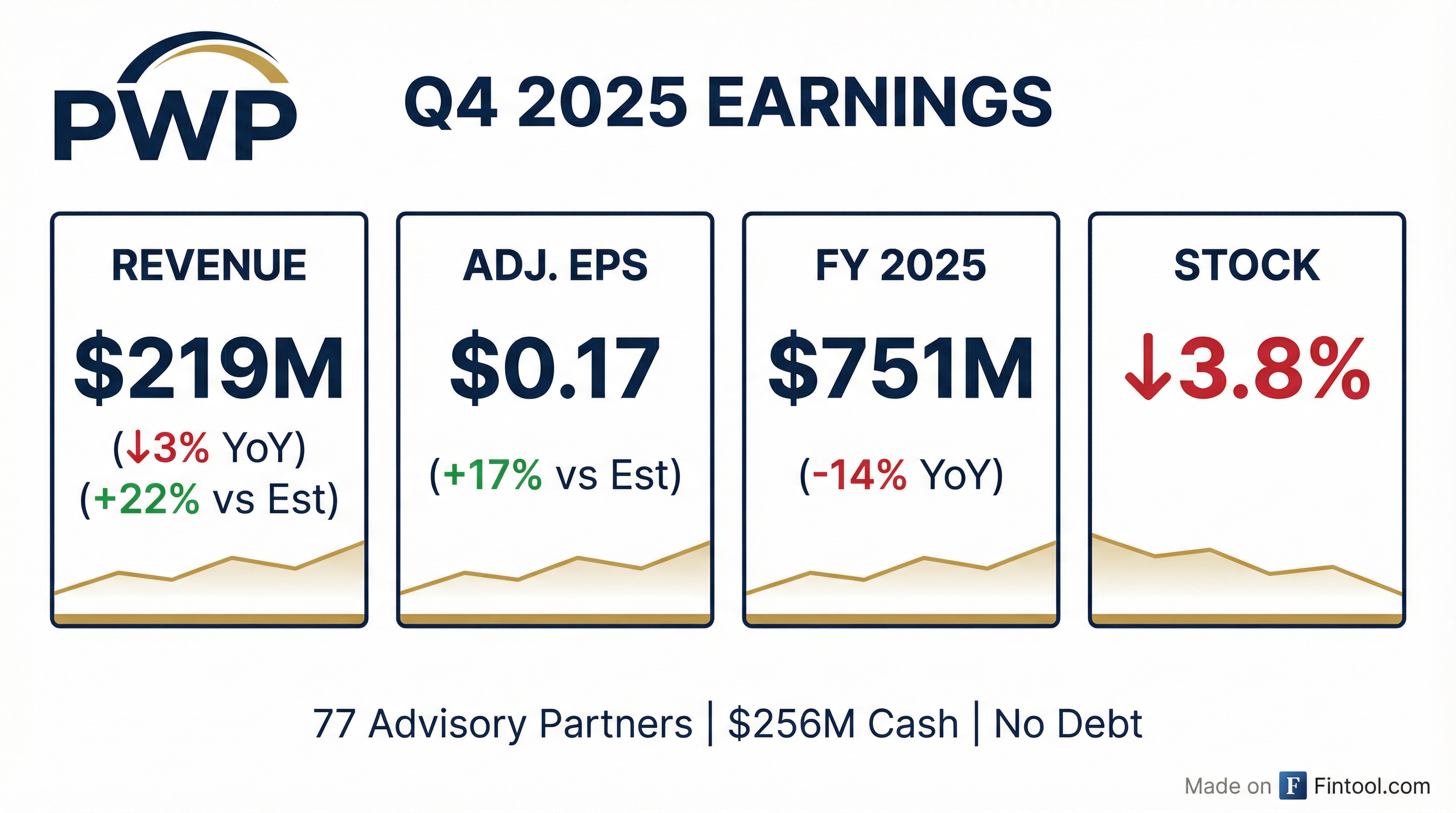

Perella Weinberg Partners (PWP) reported Q4 2025 results that beat analyst expectations on both revenue and earnings, but the stock fell 3.8% as investors focused on the year-over-year decline in advisory fees.

The boutique investment bank generated $219M in Q4 revenue, beating the ~$180M consensus by 22%, while adjusted EPS of $0.17 topped estimates by 17%. However, Q4 revenue was down 3% from $226M in the prior year, and full-year 2025 revenue of $751M declined 14% from the record $878M achieved in FY 2024.

"2025 marked the third highest revenue year in our Firm's 20-year history, demonstrating the strength and focus of our platform. Our pipeline entering 2026 stands at record levels and momentum continues to build across our business." — Andrew Bednar, CEO

Did Perella Weinberg Beat Earnings?

PWP delivered a double beat on both revenue and adjusted earnings:

Despite the beat, the year-over-year comparisons were less favorable:

How Did the Stock React?

PWP shares fell 3.8% to $21.53 on February 5, 2026 (earnings released pre-market on February 6), erasing recent gains. The stock had risen 4.5% the day prior in anticipation of results.

The stock trades near its 52-week high of $25.83 and is up ~50% from its 52-week low of $14.12.

What Changed From Last Quarter?

The FY 2025 decline reflects normalization from an exceptional 2024:

FY 2024 was a record year driven by large restructuring and M&A mandates. CEO Andrew Bednar emphasized this was "the third highest revenue year in our Firm's 20-year history" — the 2025 decline reflects tougher comparisons rather than fundamental weakness.

Strategic Talent Investment

PWP made its most aggressive talent investments in firm history during 2025:

The firm also acquired Devon Park Advisors to establish a Secondaries Advisory capability, expanding their services beyond traditional M&A and restructuring.

Management emphasized these investments "position us to capitalize on what we see as broadly favorable conditions for M&A as well as for financing and capital solutions."

What Did Management Guide?

Management provided several 2026 outlook points on the earnings call:

Key context on Q4 revenue quality: CFO Alex Gottschalk noted that Q4 revenues of $219M included $18.5M related to closings that occurred in the first few days of 2026, which were recorded in Q4 per accounting principles.

Already winning in 2026: CEO Bednar highlighted PWP announced a $15 billion transaction in January 2026, demonstrating early momentum. The firm was in zero $10B+ transactions in 2025, compared to four in the record 2024 year.

"This year, out of the gate, we're in 1 already. So I think generally, the trending is better." — Andrew Bednar, CEO

Recent Deal Highlights

PWP continues to win high-profile mandates across its advisory platform:

M&A Advisory:

- Lead financial advisor to BlackRock on its acquisitions of Global Infrastructure Partners and HPS Investment Partners

- Exclusive financial advisor to Shockwave Medical on its sale to Johnson & Johnson

- Financial advisor to Holcim on its planned North American spin-off

- Exclusive advisor to Cedar Fair on its merger of equals with Six Flags

Restructuring:

- Investment banker to FTX in its Chapter 11 cases and sale of its stake in Anthropic

- Investment banker to Spirit Airlines on its pre-arranged Chapter 11 filing

Investment Thesis Highlights

Management outlined a compelling long-term growth thesis:

Revenue Growth Drivers:

- Record pipeline entering 2026 with "momentum continuing to build across our business"

- 77 advisory partners globally, with 31% in roles less than 3 years

- Strategic investments in talent at highest levels in firm history

- Devon Park acquisition establishes Secondaries Advisory capability

Earnings Power:

- Adjusted compensation ratio of 68% for FY 2025 vs 67% in FY 2024

- Adjusted non-compensation expenses down to $159M from $162M YoY

- GAAP effective tax rate of 7%, benefiting from RSU tax benefits

Balance Sheet Strength:

- $256M cash, no debt, undrawn revolving credit facility

- $163M returned to equity holders in 2025

- Quarterly dividend of $0.07 per share declared, payable March 9, 2026

Capital Return Track Record

PWP returned $163M to equity holders in 2025 through multiple channels:

2025 Capital Return Breakdown:

- Net settlement of 3.4M share equivalents at avg $22.96/share

- Unit exchanges of 1.3M PWP OpCo units at $22.65/unit

- Open market repurchases of 1.8M shares at avg $18.40/share

- Aggregate dividends of $22.9M to Class A stockholders

Share Count at December 31, 2025:

- Class A common stock: 66.7M shares

- Partnership units: 22.1M

- Total: 88.8M

Q&A Highlights

Restructuring Outlook: Management remains bullish on the restructuring business, which hit record revenues in 2025. "We're not seeing any slowdown, particularly in liability management engagements... really prudent and very proactive finance managers with our clients that are looking ahead at maturities, covenants, and ways to enhance their balance sheet."

Europe Record Year: PWP achieved record revenues in Europe despite regional M&A volumes trending below normal for "the better part of the decade." The firm has leading share in Germany and France. Management sees opportunity from investments in defense, energy security, and infrastructure as Europe navigates geopolitical changes.

Devon Park Integration (4 months in): The secondaries advisory acquisition is going well. "The take-up rate and the conversations with our private equity clients and our credit clients and real estate clients have gone very well. And we have already jointly won new mandates."

Recruiting Platform: With 77 advisory partners covering 1,500-2,000 clients, management sees "a lot of open space" for continued hiring. The 2025 recruiting year was above-average with 23 senior additions (14 new to the platform), and 2026 is expected to return to normal trend levels.

Geopolitical Impact: CEO Bednar acknowledged geopolitical uncertainty but noted "the overwhelming majority of clients see opportunities more than they see obstacles." Once initial headline shock fades, "long-term thinking sets in" and clients are finding opportunities in energy, global manufacturing, and services.

Key Takeaways

-

Beat on the quarter: Q4 revenue of $219M and adjusted EPS of $0.17 significantly exceeded consensus, though YoY comparisons were negative

-

Third highest revenue year: FY 2025 revenue of $751M was the third highest in PWP's 20-year history, down 14% from record FY 2024

-

Record talent investment: Added 12 Partners and 11 Managing Directors in 2025 — highest talent investment in firm history

-

Record pipeline: Management highlighted record pipeline entering 2026 with momentum building across the business

-

Strong capital returns: $256M cash, no debt, $163M returned to shareholders in 2025, and $0.07/share dividend declared

For more on Perella Weinberg Partners, visit the PWP research page or read the Q4 2025 earnings transcript.